Key details

Date

- 5 April 2022

Author

- RCA

Read time

- 5 minutes

Meet Nafeesa Jafferjee and Nikos Melachrinos, founders of InnovationRCA start-up Quirk. The app helps users feel good about their finances both through tracking and managing their money, but also through learning. With inclusion at its core, Quirk is designed for Gen Z – and Nafeesa and Nikos are growing with their users.

Where did your journey as designers start?

Nafeesa: I grew up in Sri Lanka, but left at 18 to study Public Policy at Duke University in the US. I ended up not working a day in policy though. Instead my first job was at a product design consultancy in Silicon Valley helping new start-ups. That’s where I first discovered design and technology – and I knew it was the path I wanted to pursue. I taught myself design and coding skills, taking on freelance projects to build a portfolio.

I made the career transition to become a User Experience Designer, helping to scale-up a new tech start-up. I then went to work for OpenTable designing tools to help restaurants manage their reservations. I joined the MA Service Design soon after.

Nikos: I’m from Athens and growing up I never thought I’d be a designer. I went to Brown University in the US to study economics, interning in finance in the summer. Getting into design was a stroke of luck – I made some friends studying design and spent time in their studios and at their shows. That led to me taking a course in design thinking and another in graphic design. I was inspired so I started working with other students and publications to design posters and graphics. At the same time I was taking a module in entrepreneurship and working on a start-up project and found the design skills I had picked up were very handy as we conceptualised our idea.

I’d found a love for entrepreneurship and technology, and after graduating I moved to San Francisco to join a legal tech start-up and ending up moving to London with them. I was seeing the success of design led companies like Airbnb and wanted to build my own design skill set. I discovered the RCA’s MA Service Design – it made perfect sense. I was fortunate enough to be accepted.

“From the very beginning, we were designing a service for the real world.”

How did Quirk start?

Nikos: Quirk came from our final year project at the RCA. We chose a project brief in partnership with Telefónica, to come up with a service using AI to improve people’s wellbeing. We had bonded over our shared interest in financial services – Nafeesa feeling like she was financially illiterate and I, having worked in banking, feeling angry with bad finance services exploiting people.

Nafeesa: We decided to focus our project on wellbeing and money. We worked directly with Telefónica ’s ‘moonshot factory’, Alpha (now spun off into Koa Health), to come up with a problem-solving project that could be launched to market. From the very beginning, we were designing a service for the real world.

So how does the app work?

Nafeesa: Quirk is a personalised app that demystifies finances to help our users build financial literacy and manage money better. There are a few key features.

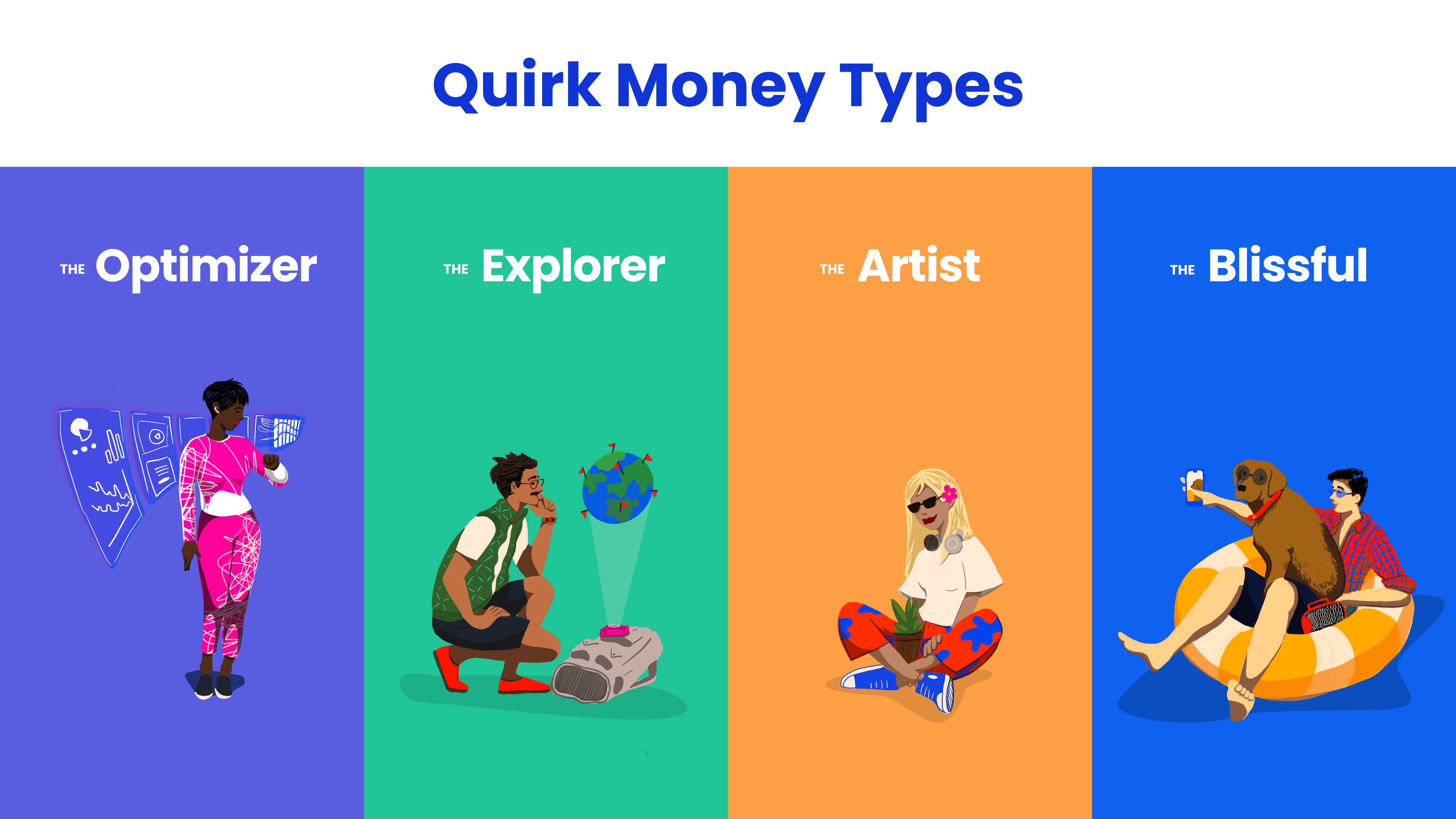

Firstly, we help you to discover your money personality through a test developed with experts. This helps you learn more about your financial behaviour. Based on your personality type, we give you tips on how to manage your money and tailor your user experience. It also connects all your accounts via Open Banking to give you a full financial overview. This is a secure way to connect your different bank accounts like current, credit and savings so you can view your bank balances and transactions in one place.

“Gen Z will soon make up 40% of global consumers.”

Nikos: We also help you track your spending. Budgets can often feel restrictive and boring. We help users set up spending goals focusing on spending beyond fixed living costs, tracking spending against factors that are important to them.

Finally, we help our users learn the basics of personal finance. Through the app, we are able to give all of them a step-by-step guide on how to boost financial health. Educating our users on finance from ISAs to credit scores through bite-sized content.

Quirk also uses psychological theory to help users, can you tell us more about that?

Nafeesa: We use psychology in a lot of different ways. Our personality test helps users understand how traits like extraversion or risk appetite can affect their spending, saving and investing. We also use positive reinforcement to help users build financial habits. We personalise the language in our notifications because making users feel ashamed often leads to giving up on financial goals.

Nikos: Another way we incorporate psychology is through gamification. Giving rewards for reaching goals, even if they are just virtual, helps users stick to better financial habits. This is just a quick overview, but we’re constantly incorporating insights from behavioural science and increasingly personalising the user experience to help people stick to their money goals long-term!

What sets Quirk apart from other apps on the market?

Nafeesa: There are a lot of tools out there for an older audience that require existing knowledge on how to manage your money. Quirk demystifies finances and bridges the knowledge-action gap, combining financial education with money management tools.

Nikos: We’re also a design first company offering simple, well-designed tools with a much friendlier user experience compared to other apps in the market. We’re also building a brand with a strong focus on community, with our faces and stories as founders out there on social media establishing a direct relationship with a community of users.

Nafeesa: Also, we are building financial products built on top of web3/crypto infrastructure meant for the ‘on-native’ crypto users, which we haven’t seen in the market yet.

“The MA Service Design pushed us to tell a compelling story and bring the user journey to life.”

Why do you think Gen Z are not catered for by fintech apps?

Nikos: Gen Z is still a young demographic and not viewed as a lucrative market, so a lot of financial services have focused on older generations that have accumulated more wealth. Gen Z, however, will soon make up 40% of global consumers with a $140 billion spending power and so we know that they are a huge emerging opportunity. By becoming the first players to win them over, and from a young age, we will be able to grow with them and provide financial services along their journey.

Nafeesa: We have also created content specifically targeting women who have been traditionally underserved by financial services to get them on equal footing when it comes to building wealth. Currently 56% of women make up our user base, when they typically make up about 20% of many popular fintech apps.

You’ve won a significant amount of seed funding, how did the RCA and InnovationRCA prepare you for bidding for funding from investors?

Niko: The MA Service Design played a major role. The programme pushed us to tell a compelling story and bring the user journey to life. Early-stage investing is an emotional decision, so telling stories about real people and how our product makes a difference for them is an essential part of a good pitch. That’s helped align investors with us thus far.

Nafeesa: At InnovationRCA we went through ‘investor readiness training’, which involved endless pitching and refining of our pitch deck. It really helped to perfect our pitching before we got in front of investors. Having a well-crafted deck and being prepared to answer key questions about the business like how we acquire users, how we monetize and what the future roadmap looks like.

“The higher up design is involved in leadership, the more we can build services, apps and a user experience that are more inclusive.”

Where do both of you want to go in the future?

Nafeesa: For me, it’s more about becoming a design leader. Using design to inform the strategy and culture of a business by putting people at the centre of it. I personally believe the higher up design is involved in leadership, the more we can build services, apps and a user experience that are more inclusive and put the customer's needs first. My future, I think, will be helping organisations by using Quirk as a design thinking vehicle to drive innovation within businesses. Designing better products that don’t just live as concepts but get built.

Nikos: I look at design hand in hand with accessibility and equality. I’m most excited about using design to improve the access and use of financial services. That is partly based on the existing financial infrastructure, and partly in the growing world of web3/crypto, which certainly has many design and access challenges. I’m focused on growing Quirk and carrying on building within this sector, using design as a guiding force to create good products and services. And while the technology and interfaces change, the core questions on financial inclusion are still very much the same.